M.E.U.

Middle East UK (MEU Investors)

A boutique M&A firm

Welcome To MEU Investors

At MEU Investors, our priority is to ensure we work with you to find you the most suitable solution.

We look at potential acquisitions depending on some criteria, we also offer services on an independent basis to support you through an acquisition process, due diligence, independent valuation, post-acquisition merging etc.

Read More

Click Here To Meet The Team

Every member of our team has made significant contributions in M&A in a private investor setting or as part of the Big Four accounting firms.

Each one brings a unique set of skills and expertise to our organization.

MEU Acquisitions

We provide employers with practical and strategic advice and guidance.

Button

M&A Full Cycle Transaction Support

We help create business entities, such as corporations, partnerships and joint ventures.

Button

Due Diligence Support

Draw upon our full complement of services to safeguard and manage your assets.

Button

Independent Valuation

Business disputes are part of every business. We help you protect your best interests.

Button

Support

Consult with us for Acquisition process support, Due Diligence Support, gain an independent Valuation.

Public squabble between the two largest offshore exchanges’ bosses led to run on FTX and forced saleThe two largest offshore cryptocurrency exchanges are merging, after a week of public squabbling between Binance’s chief executive, Changpeng Zhao, and FTX’s boss, Sam Bankman-Fried, triggered a bank run at the latter’s exchange and an embarrassing forced sale on Tuesday.“This afternoon, FTX asked for our help,” tweeted Zhao. “There is a significant liquidity crunch. To protect users, we signed a non-binding [letter of intent], intending to fully acquire FTX.com.” Continue reading...

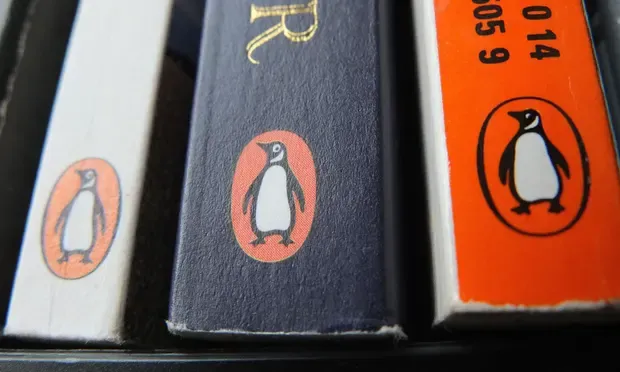

The failure of a recent bid to merge two large publishing companies shines a light on a central issue of cultural powerDespite a rise in self-publishing, commercial publishers are still the main gatekeepers of what arrives on our bookshelves. As such, they have great cultural and – if a book takes off – economic power. A case decided in a US court this week provided an insight into just how much of that power is now concentrated in a small handful of multinational companies.At issue was a planned merger of Simon & Schuster with Penguin Random House (PRH) – two of the so-called big five, which between them control 90% of the US publishing market, a fact not always obvious to the casual observer, as books usually carry on their spines the names of imprints, or subdivisions, of the parent company. PRH, itself the result of a mega-merger in 2013, runs about 300 imprints. Given the reach of these companies – PRH is active in more than 20 countries – the Department of Justice’s successful argument that the planned $2.2bn deal would “exert outsized influence over which books are published in the United States and how much authors are paid for their work” applies globally. Continue reading...